Financial Services for Individuals

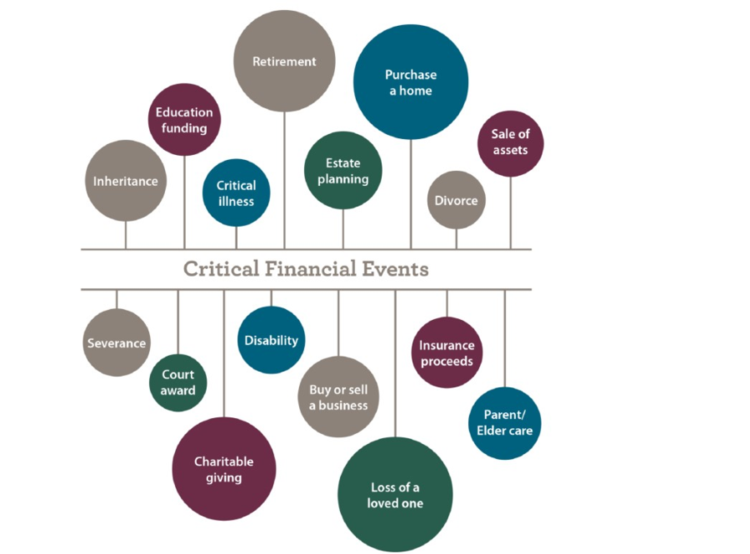

The Pidgeon Group tailors every investment plan to the needs of each individual client. Together we assess where you are today in relation to where you want to be in the future. Your investment plan is constructed as a unique roadmap with strategies to help achieve your financial goals. Below are examples of themes we may introduce that lead to objective reliable solutions:

Financial

-

Customized Investment Planning

-

Asset Allocation

-

Investment Strategies

-

Cash Flow Analysis

-

Risk Management & Insurance

-

Tax Efficient Investing

-

Budgeting

Family

-

Estate Planning Strategies

-

Education Planning

-

Multi-Generational Succession Planning

Career

-

Retirement Planning

-

RSU & Stock Option Services

-

401(k) Plan Education

-

Business Exit Planning

Personal

-

Coordination with Your Professional Alliances

-

Life Intersection Consulting

-

“What’s Next for Me" Planning

-

Legacy Planning

Impact

-

ESG & Socially Responsible Investing

-

Donor-Advised Fund Creation

-

Charitable Giving

__________________________________________

Investment Strategies

Here are some popular ways we assist clients:

Charitable Giving

You may be considering a philanthropic donation of appreciated assets to a charitable organization. We can show you how to make tax-intelligent decisions while supporting the institutions you value most. We will work in coordination with your legal and tax advisor to help you make appropriate choices, as we are not meant to give tax advice or to take the place of your tax advisor. Charitable Giving.

Estate Planning

By taking steps today to review your will and estate documents with your professional legal advisors, you can protect your heirs from substantial delays, fees and taxes. The Pidgeon Group can assist you in reviewing or developing estate planning strategies that will help simplify the transfer of your estate to your beneficiaries. We can work with you and your network of trusted professional advisors, including your tax and legal counsel, to devise a strategy that is most appropriate for your situation. If you are not already working with an accountant or legal professional, we can make an introduction.

Wells Fargo Advisors is not a legal or tax advisor

Retirement Planning

One of our major focuses is ensuring that our clients have a plan for a comfortable retirement. We provide comprehensive, practical retirement planning that can help put you on track to pursue your goals. If you receive a distribution from an employer-sponsored retirement plan, we can help analyze your available choices, coordinate recommendations with your tax professionals, and assist you in identifying the course of action that makes the most sense for youLending Services

Through our Wells Fargo affiliates, you have access to banking services, including:

- Securities-based lines of credit

- Residential mortgages

- Home equity financing

- Small-business financing

- Credit Cards

Lending and other banking services available through Wells Fargo Advisors (NMLS UI 2234) are offered by banking and non-banking subsidiaries of Wells Fargo & Company, including, but not limited to Wells Fargo Bank, N.A. (NMLSR ID 399801), Member FDIC, and Wells Fargo Home Mortgage, a division of Wells Fargo Bank, N.A. Certain restrictions apply. Programs, rates, terms, and conditions are subject to change without advance notice. Products are not available in all states. Wells Fargo Advisors is licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act and the Arizona Department of Financial Institutions (NMLS ID 0906158). Wells Fargo Clearing Services, LLC, holds a residential mortgage broker license in Georgia and is licensed as a residential mortgage broker (license number MB2234) in Massachusetts.

Tax-Advantage Programs

The Pidgeon Group offers investors with large portfolios of municipal bonds the opportunity to take full advantage of one of the few remaining tax-advantaged investments. The centerpiece of the program is a complete analysis of your bond portfolio holdings. Based on your needs, we can provide a series of detailed reports, including income-flow analysis, maturity alert, yield and coupon analysis, and rating analysis, that can help you manage your bond portfolio. We have the ability to review and analyze fixed income exchange traded funds, mutual funds, unit investment trusts and closed-end funds.

Municipal bonds are subject to availability and change in price. They are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.Education Funding

For many families, education costs are major expenses that require careful planning. We can help you by establishing a 529 College Savings Plan for your child or grandchild.* These plans offer professionally managed, tax-advantaged portfolios to help plan for rising college expenses.*Please consider the investment objectives, risks, and charges and expenses carefully before investing in a 529 savings plan. The official statement, which contains this and other information, can be obtained by calling your financial advisor. Read it carefully before you invest.

Insurance Services

As part of our comprehensive strategy, we can assist you with selecting products and services that can help prepare you for major life-changing events, including:

- Term life insurance

- Long-term-care insurance

- Income-replacement analysis

- AnnuitiesInsurance products are offered through nonbank insurance agency affiliates of Wells Fargo & Company and are underwritten by unaffiliated insurance companies.